OP ED #2 CRITICAL MINERALS | Australia’s once in a generation lithium opportunity

Sign up for updates

Sign up to receive occasional updates on major climate and energy finance news and developments, and notification of new reports, presentations and resources.

"*" indicates required fields

Read our privacy statement here.

OP ED #2 CRITICAL MINERALS | Australia’s once in a generation lithium opportunity

By Tim Buckley and Matt Pollard, CEF.

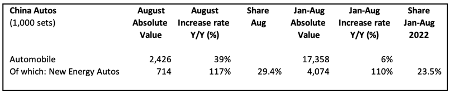

Global critical minerals demand is expected to surge five to tenfold over this decade, underpinned by the accelerating energy transition. Global supply shortages are already evident, driving many key commodity prices to record highs. This has been compounded by two factors. Firstly, Putin’s invasion of Ukraine has seen sanctions against Russia, one of the key suppliers of many of these minerals. Secondly, China’s electric vehicle (EV) sales are up 110% year-on-year year to date August 2022, exceeding almost all global EV forecasts, yet again.

Supply chain security issues exacerbated by over-reliance on China and Russia have created a once-in-a-generation opportunity for Australia that is economically transformative, and on a scale that surpasses even our previous dominance in commodities. Australia is the world’s largest exporter of iron (55% global seaborne share), LNG (20%) and coal (30%), and we can now add lithium spodumene (79%) to this key list.

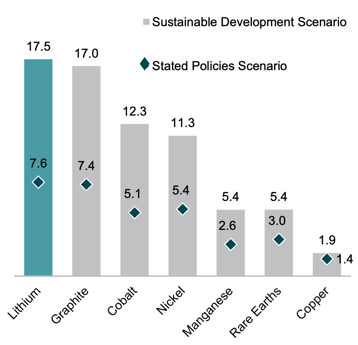

The International Energy Agency (IEA) forecast global demand for critical minerals like lithium, graphite, cobalt and nickel could grow by 5-7 times this decade under the Stated Policies Scenario, or 11-17 times under the more Paris-aligned Sustainable Development Scenario. Rare earth demand could rise 3-5 times, and copper by 40-90% with electrification of everything – Figure 1.

Figure 1: Clean Energy Minerals Demand Growth 2030 vs 2020 (times)

Source: IEA, Mineral Resources FY2022 Results Briefing, 29 August 2022

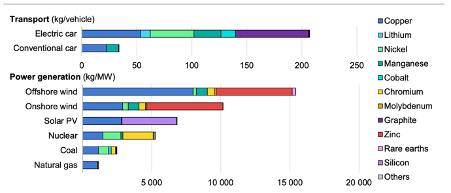

While the global economic development of the past few decades has been massively reliant on steel, cement and fossil fuels, the energy transition now underway will lower the absolute dependence on bulk commodity mining, and change the composition of mining radically. The energy transition’s reliance on critical minerals (or future facing commodities, to use BHP’s parlance) will rise dramatically – Figure 2. This IEA chart does not include the massive mining intensity of coking coal, thermal coal or methane gas mining, but for Australia, that is the key issue. As the world’s largest LNG and coal exporter, we need to understand this means a change in our world-leading mining industry. But not necessarily a contraction, if we invest in onshore refining powered by renewables to drive decarbonisation.

Figure 2: Mineral Intensity of Selected Clean and Fossil Energy Technologies

Source: IEA, The Role of Critical Minerals in Clean Energy Transitions, May 2021

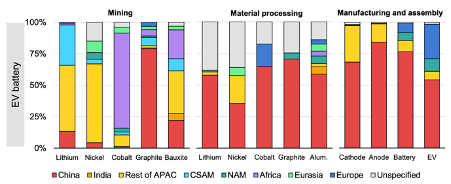

China dominates the processing of most critical minerals, as well as aluminium, steel, nickel, polysilicon, graphite, batteries, EVs, solar modules and wind turbines. For the EV supply chain, China’s technology, investment, employment and export dominance is clear – Figure 3.

Figure 3: Geographic Concentration of EV Technologies by Supply Chain, 2021

Source: IEA, Securing Clean Energy Technology Supply Chains, July 2022

This has received much too little global attention,[1] even noting the US military briefed Congress a decade ago in terms of the growing strategic risks.[2] The subsequent investment of US$1.5bn in recommissioning the Mountain Pass rare earth facility by Molycorp[3] was an abject lesson in the failure of US Congress to follow through with clear strategic intent, with the ultimate irony being the facility was allowed to fail,[4] then allowed by then President Trump to be acquired out of bankruptcy by the Chinese for 1c in the dollar.[5] President Biden has made the expansion of domestic battery manufacturing supply chains a pre-condition of the new US EV stimulus included in the Inflation Reduction Act (2022).[6] This has opened up a significant value-adding opportunity for rare earths refining in Australia and the U.S., with Lynas Rare Earths and Iluka Resources both advancing new projects.

China’s EV sales are up 110% year-on-year (yoy), year to date August 2022 to be almost 60% of total EV sales globally, meaning every global EV forecast has been exceeded, yet again this year – Figure 4. For the month of August 2022, EV sales were +117% yoy, setting another record high 29.4% national share of all auto sales in China.

Figure 4: China’s Auto and EV Sales, August 2022 and January-August 2022

Source: China National Bureau of Statistics, 16 September 2022

Australia has long been the quarry to the world. And once again, we are blessed as the lucky country, being a top 5 supplier of all these critical minerals. In lithium, our global supply dominance exceeds that of iron ore, with a 79% global share of hard rock mining – lithium spodumene – in 2021. South America dominates the smaller supply of lithium brines.

Experts like Professor Ross Garnaut and Dr Alan Finkel have long argued that Australia will be a Renewable Energy Superpower.[7] The global challenge of decarbonisation means that Australia is also perfectly positioned to be a Critical Minerals Mining and Refining Superpower, leveraging our world leading wind and solar resources, our huge, relatively sparsely populated continent and our financial market depth at a potential scale unrivalled by any other nation (except China, which already leads the world).

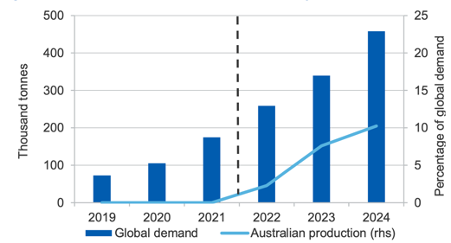

Australia is already the world’s largest producer and exporter of hard rock lithium spodumene. Figure 5 details the start of what Climate Energy Finance expects to be a new trend, of global significance, for Australia – an onshore lithium processing industry, producing the precursors for lithium-ion battery cathodes. The first of two trains at Australia’s first lithium hydroxide monohydrate (LHM) plant was commissioned in May 2022 at Kwinana, Western Australia (WA). A second two-train LHM plant at Kemerton, WA had its first train commissioned in July 2022. And a third LHM plant is due to be commissioned at Kwinana by the end of 2024.

The Office of the Chief Economist forecasts Australia will account for 10% of global LHM production by 2024, rising to potentially 20% by 2027. With another two WA plants proposed (both pre-Final Investment Decision), this could be conservative. China currently processes 60% of the world’s LHM, almost all sourced from Australian lithium spodumene mines, highlighting the strategic opportunity for Australia to value-add before export.

Figure 5: World and Australian Lithium Hydroxide Monohydrate Output

Source: Bloomberg NEF, Office of the Chief Economist[8]

It is also telling that all the global lithium giants are involved in the Australian lithium sector, as is demonstrated by the ownership of the three onshore LHM refineries:

- IGO Ltd (ASX listed) has partnered with Tianqi Lithium of China in the Tianqi Lithium Energy Australia (TLEA) joint venture LHM Kwinana Facility, 48,000tpa LiOH;

- Mineral Resources (ASX listed) has partnered with Albermarle Co. of the U.S. in building the Kemerton LHM plant, 50,000 tpa LiOH; and

- Wesfarmers (ASX listed) has partnered with SQM of Chile in the Kwinana LHM Plant 50,000tpa LiOH due for commissioning by end 2024.

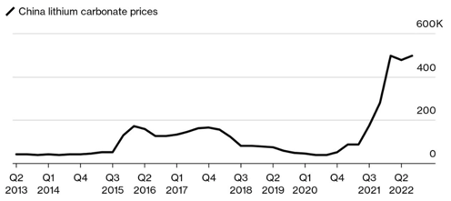

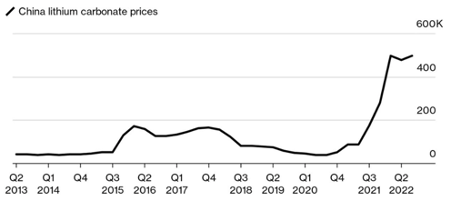

The timing of this collective A$4bn of capital investment in lithium refining is currently looking perfect. The Chinese price of lithium spodumene has risen tenfold – Figure 6.

Figure 6: Lithium Carbonate prices (RMB)

Source: Asian Metal Inc, Bloomberg

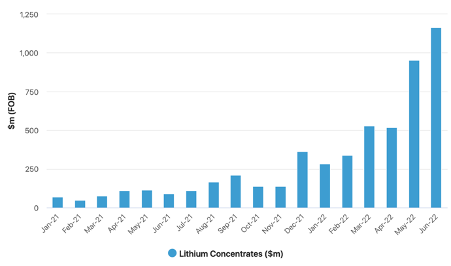

Australia is at the start of a globally significant investment boom. The top 5 ASX listed pure-play lithium firms have a collective market capitalisation now exceeding A$50bn, up eightfold since 2016. Figure 7 details the monthly value of lithium concentrates exports for Australia. The majority of the recent uplift is the booming price, which has risen eightfold in the last 18 months to a record A$800/kg in June 2022.

Figure 7: Australian Lithium Concentrate Exports (A$m per month)

Source: ABS

Climate Energy Finance views the investment, regional employment, technology and value-added export potential of the global energy transition as a once in a generation opportunity for Australia. Competing with the largely state owned, world leading energy giants of China is largely beyond the financial capacity of private markets alone, meaning strategic policy settings that catalyse industry development and co-investment by the Australian government will be key to Australia maximising its potential. The return on investment will be evident as Australia establishes itself as a value-added critical minerals sector leader, with the concomitant benefits for energy independence and supply chain security, critical geostrategic considerations in our increasingly volatile and warming world.

BlackRock’s CEO Larry Fink has referenced the “accelerating tectonic shift” in global capital markets toward clean energy. Australia needs to remain nimble and strategic to ride this global wave without delay, particularly after the inertia, climate science denialism and intransigence of the previous Federal government – and the huge opportunity cost that its epic policy failure entailed. All Australians are paying the price of this lost decade. The immense opportunities of the transition are now ours for the taking.

In subsequent op eds we will explore ten of the leading mining value-add projects underway in Australia, and then the public and private financial instruments being leveraged to deploy capital at the scale needed.

This oped is for public interest purposes highlighting the national strategic interests and opportunities for Australia from the global energy transition. It should not be construed in any way as general nor specific financial advice. The authors own shares in BHP and Wesfarmers.

[1] CGTN, How China is leading in global energy transition, 17 August 2022

[2] Congressional Research Service, Rare Earth Elements in National Defense: Background, Oversight Issues, and Options for Congress, 23 December 2013

[3] Mining Technology, Mountain Pass Rare Earth Mine Modernisation Project, California, 19 June 2014

[4] Defensenews.com, The collapse of American rare earth mining — and lessons learned, 13 November 2019

[5] Mining.com, Mountain Pass sells for $20.5 million, 16 June 2017

[6] Bloomberg, Senate Deal Includes EV Tax Credits Sought by Tesla and Toyota, 28 July 2022

[7] Ross Garnaut, Energy: Superpower: Australia’s low carbon opportunity

[8] Australian Government, Resources and Energy Quarterly: June 2022, 4 July 2022