OP ED #1 CRITICAL MINERALS | More than a quarry: The growing investment into value-adding critical minerals mining in Australia

Sign up for updates

Sign up to receive occasional updates on major climate and energy finance news and developments, and notification of new reports, presentations and resources.

"*" indicates required fields

Read our privacy statement here.

OP ED #1 CRITICAL MINERALS | More than a quarry: The growing investment into value-adding critical minerals mining in Australia

By Tim Buckley and Matt Pollard, CEF.

The energy transition will require a fundamental reshaping of the global landscape. We forecast US$100 trillion cumulative investment in the global energy sector through to 2050,[1] creating all sorts of financial implications and opportunities. There are also dramatic geopolitical implications, many of which have taken on new prominence with Putin’s invasion of Ukraine, and the associated sanctions and disruptions of oil, gas and coal supply from the world’s second largest fossil fuel exporter. The imperative to decarbonise – and to secure energy supply chains and energy independence – has never been greater.

Australia is perfectly positioned to emerge as a renewable energy superpower. Australia is also blessed with huge resources of critical minerals, such that we can also become a future facing mining superpower, and the regional employment and investment opportunities could be multiplied if we collectively and rapidly upscale ever-lower cost domestic renewable energy to power value-added pre-export minerals refining onshore. We look here at some key developments.

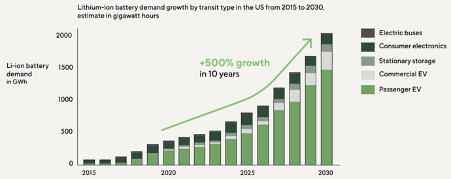

The investment and mining sectors are full of discussion about the commodity shift from burning fossil fuels to the ‘New World Metals’ needed for decarbonisation and electrification.[2] In September 2022, BNEF forecast global copper use will increase more than 50% by 2040 even as copper ore grades decline.[3] Demand for critical minerals is booming, and diversifying refining from China’s dominance is Australia’s opportunity.[4] Lithium demand is forecast to grow fivefold by 2030 – Figure 1

Figure 1: Mass Electrification Will See US Battery Demand Grow Fivefold by 2030

Source: Redwood Materials US

Australia’s Chief Scientist, Professor Cathy Foley, has written about the booming demand for critical minerals, Australia’s abundance of deposits, and the opportunity for high skilled regional jobs in value-adding, an “excellent economic opportunity to cement Australia into the global supply chain for low-emissions technologies.”[5] Ex-Chief Scientist Dr Alan Finkel likewise notes the imperative to change Australia’s “dig and ship” economy has intensified.[6]

And this month has seen Tesla Chair Robyn Denholm talk on how Australia is missing out on the “value-add” from its mineral resources, urging investment to establish the infrastructure to refine and manufacture battery cells and EVs.[7]

Australia is starting to diversify away from its mining export reliance on iron ore and fossil fuels. Lithium exports are forecast to hit $7.7bn in 2023, up sevenfold in value terms in just two years. Nickel exports are forecast to double to A$6.6bn and copper exports are up 20% in two years to a forecast $14bn.[8]

Australia’s major mining houses are well underway in this strategic repositioning.

Underlying its divestment of its petroleum business to Woodside, BHP has progressively pivoted its corporate strategy to “secure further growth opportunities in future facing commodities” essential to the energy transition and economic growth, with CEO Mike Henry noting that, “The world will need more copper and nickel for electrification, renewable power and electric vehicles.”[9] This follows the significant de-weighting of coal in BHP’s portfolio with the Sounth32 spin-off back in 2017. BHP 2022 asset split is 50% copper/nickel, 31% iron ore, 14% coal and 7% potash (although the gross profit spilt is 52% iron ore weighted reflective of this division’s exceptional profitability).[10]

Meanwhile, Rio Tinto is following a similar path, having fully divested from coal back in 2018,[11] and now looking to dramatically ramp up its copper exposure via development of the Oyu Tolgoi mine in Mongolia[12] and the Rincon lithium brine deposit in Argentina.[13]

Wesfarmers completed its exit from coal in 2018[14] and then in 2019 pivoted aggressively into lithium mining at Mt Holland and lithium refining at Kwinana.[15]

This trend is also clear in the capital raisings of new ASX listings and the surge in exploration spending, with mineral exploration by all companies in Australia in the June 2022 quarter hitting a record $1.04bn even as petroleum exploration fell 21% to $245m. Lithium exploration hit a record $600m or 60% of all Australian minerals exploration.[16]

Australia’s top 5 pure lithium companies[17] now have a combined market capitalisation exceeding A$50bn, up eight-fold over the last 7 years.

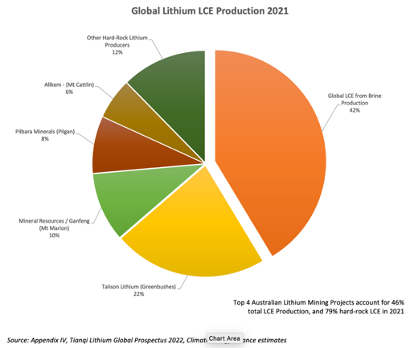

Australia is already the largest exporter of lithium, with a 2021 global mining share of 46% of Lithium Carbonate equivalents (LCE), or 79% of global hard rock lithium production (i.e., excluding non-battery grade lithium brines, produced in South America) – Figure 2.

Figure 2

In 2021 Australia was the world’s largest exporter of iron ore, coal, LNG and lithium. The ‘quarry to the world’, with zero value-add in any of these undertaken here.

But this is changing, at least for lithium. May 2022 saw Australia commission its first lithium hydroxide refinery, the Tianqi Lithium (China) and ASX-listed IGO Ltd’s joint venture, Tianqi Lithium Energy Australia (TLEA). This joint venture’s first phase at Kwinana, Western Australia has a capacity of 24,000 tonnes per annum (ktpa). TLEA is expected to reach a financial investment decision (FID) on phase two to double to 48ktpa in FY2023.

A second lithium hydroxide refinery of 50ktpa was commissioned in July 2022. This was built at Kemerton, WA by a 60:40 joint venture between Albemarle Co (US) and ASX-listed Mineral Resources.

A third lithium hydroxide refinery of 50ktpa is being built at Kwinana, WA by the Wesfarmers / SQM of Chile joint venture, due for commissioning by end CY2024.

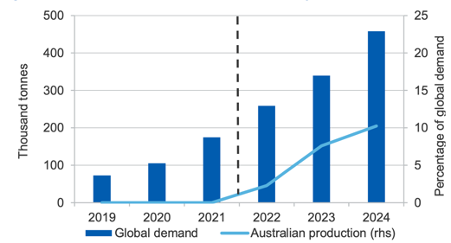

These three refineries have a combined capital cost of some A$3.7bn and will see Australia export an estimated 10% of the world’s lithium hydroxide by 2024 – Figure 3 – and potentially 20% by 2027. And ASX-listed Liontown Resources has proposed a fourth 86ktpa lithium refinery (yet to reach FID). Lithium hydroxide is worth US$35,000/t in 2022, a fifteenfold increase on lithium spodumene at US$2,000-3,000/t.

Figure 3: World and Australian Lithium Hydroxide Output

Source: Bloomberg NEF, Office of the Chief Economist[18]

Australia is likewise a significant exporter of mined copper (#4 in the world, with a 4% global share), nickel (#4, 5% share (but 25% of the world’s resources)), [19] rare earths (#4 in the world, 9% share) and cobalt (#3 in the world (but 19% of the world’s resources)).[20] But today Australia exports the majority of our commodities straight from the mine, with limited refining value-adding.

The regional employment and investment opportunities for Australia can be doubled by undertaking refining pre-export, particularly with the weakening A$/US$. And given commodity refining and processing is very energy intensive, this can also leverage our global competitive advantage in zero emissions, low-cost world scale renewable energy.

Whilst there are some emerging investment proposals for downstream value-adding e.g. Energy Renaissance’s proposed 300MWh pa battery manufacturing facility at Newcastle, NSW[21] and EcoGraf‘s proposed battery anode factory in WA, the reality is that almost all new battery manufacturing is being located close to EV manufacturing e.g. CATL’s 100GWh US$7.6bn investment proposal for Hungary.[22] President Biden has made domestic battery manufacturing a pre-condition of the new US EV stimulus included in the Inflation Reduction Act.[23]

Our conclusion is clear: there is huge potential for Australia to undertake refining and processing of our mineral resources before export. The growing global focus on decarbonisation plays to Australia’s competitive advantage, given our almost unlimited low-cost renewable energy potential to power the refineries needed to supply the burgeoning demand for critical minerals.

This is the first of a series of four op eds. The next will review ten critical mineral refining value-adding projects well underway across Australia today, to illustrate how investment and regional employment opportunities are building, the third will review how public and private debt and equity financing is playing a key role, and the fourth will review another ten Australasian investment proposals that further leverage our global position in value-adding critical minerals.

This oped is for public interest purposes highlighting the national strategic interests and opportunities for Australia from the global energy transition. It should not be construed in any way as general nor specific financial advice. The authors own shares in BHP and Wesfarmers.

[1] https://www.iea.org/reports/world-energy-investment-2022/overview-and-key-findings

[2] The Australian, New World Metals conference opens roadshow as metals demand spikes, 9 September 2022

[3] Bloomberg, Surging Copper Demand Will Complicate the Clean Energy Boom, 1 September 2022

[4] The Geopolitics of Critical Metals and the Green Revolution, 22 June 2022

[5] The Australian, Critical minerals offer us a new kind of mining boom, 31 August 2022

[6] Canberra Times, Aust tipped to be powerful ‘electro state’, 14 September 2022

[7] AFR, Australia is missing out’ on battery revolution: Tesla chairman, 14 September 2022

[8] Australian Government, Office of the Chief Economist, Resources & Energy Quarterly Report, June 2022

[9] BHP, Growing value and positioning for the future, 18 August 2021

[10] BHP 2022 financial results and operational reviews, 16 August 2022

[11] Renew Economy, Rio Tinto’s restructuring signals global industry move away from coal, 5 March 2015

[12] AFR, The global war for copper is just getting started, 12 September 2022

[13] Rio Tinto, Rio Tinto completes acquisition of Rincon lithium project, 29 March 2022

[14] Reuters, Australia’s Wesfarmers quits coal with $635 million mine sale, 7 August 2018

[15] AFR, Wesfarmers says lithium play part of taking carbon out of economy, 2 May 2019

[16] AFR, Mining exploration spend of $1b hits record levels, 2 September 2022

[17] Pilbara Minerals, IGO Ltd, Liontown Resources, Mineral Resources and Allkem Ltd; excluding Wesfarmers (50% owner of Covalent Lithium) as a conglomerate.

[18] Australian Government, Resources and Energy Quarterly: June 2022, 4 July 2022

[19] Australian Government, Resources and Energy Quarterly: June 2022, 4 July 2022

[20] West Australian Government, A Global Battery and Critical Minerals Hub, June 2022

[21] The West Australian, Aussie lithium battery giga-factory online, 1 Sept 2022

[22] CATL, CATL Announces its Second European Battery Plant in Hungary, 12 August 2022

[23] Bloomberg, Senate Deal Includes EV Tax Credits Sought by Tesla and Toyota, 28 July 2022