ANALYSIS | Green hydrogen momentum is building, but is a decade from commercialisation

Sign up for updates

Sign up to receive occasional updates on major climate and energy finance news and developments, and notification of new reports, presentations and resources.

"*" indicates required fields

Read our privacy statement here.

ANALYSIS | Green hydrogen momentum is building, but is a decade from commercialisation

Green hydrogen is a major new energy technology in development, one of the many tools to help drive global decarbonisation. Whilst electrification of everything is a central driver of decarbonisation globally, leveraging the ever lower cost of domestic zero emissions firmed renewable energy, this will create opportunities for green hydrogen, most immediately in replacement of the existing high emissions fossil hydrogen supply (in terms of ammonia use in fertilisers, mining explosives and refining). There is also significant potential to grow new niche use applications in steel, shipping, imported coal and gas blending and long-distance heavy transport. But we need to beware of the excessive hype around hydrogen, and the associated greenwash of the LNG and methane pipeline industry sectors in promoting so called blue hydrogen. This is hydrogen produced using fossil fuels with the presumption of use of the non-commercialised technology of carbon capture and storage – touted by the fossil fuel industry as the potential panacea for the methane gas industry’s hypothetical path to decarbonisation.

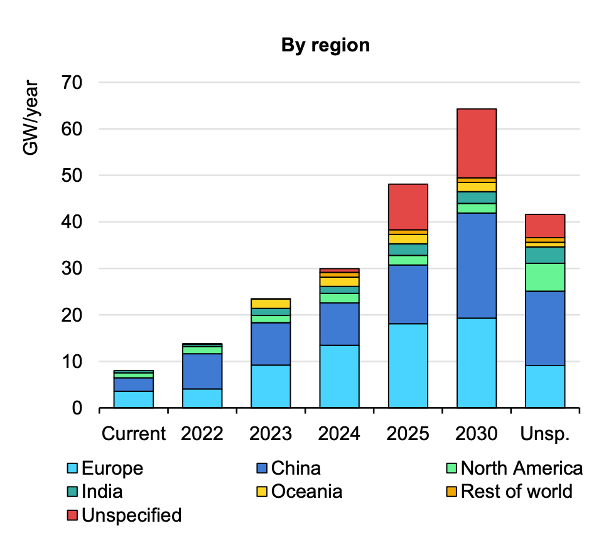

Green hydrogen will be commercially viable in certain sectors and geographies, for example steel, fertilisers, and refineries as well in countries with aggressive decarbonisation objectives but also major ongoing energy security risks and limited domestic renewable energy resources, such as Japan, Korea and the UK. However, it is a decade away from commercial viability absent massive subsidies. First, we need to see ongoing deflation in firmed renewable energy costs as well as a massive upscaling in electrolyser manufacturing capacity (Figure 1), which in turn will likely see installed electrolyser capital costs drop by 50-70% over the coming decade.

Figure 1: Electrolyzer Manufacturing Capacity by Region to 2030

Source: International Energy Agency, Global Hydrogen Review, September 2022

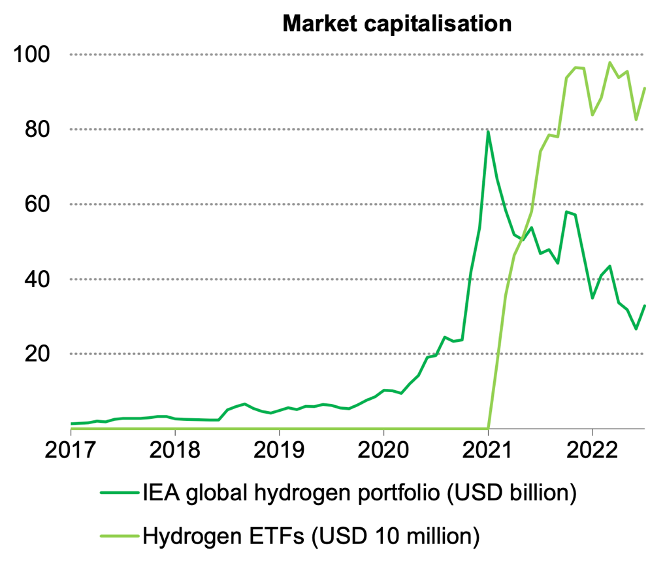

The global hydrogen hype peaked back at the start of 2021, as evidenced by the share price corrections of leading green hydrogen firms like Plug Power, NEL and ITM – Figure 2. They have collectively dropped by more than 50% since, even as tangible hydrogen momentum has built. The good news is many of these hydrogen pure plays collectively raised billions of dollars of new equity capital before the bubble burst, and so the subsequent deployment of this capital has underpinned the much needed scaling up of hydrogen manufacturing capacity and RD&D.

Figure 2: Global Hydrogen Firms Market Capitalisation (US$bn)

Source: International Energy Agency, Global Hydrogen Review, September 2022

On top of this, the German, UK and EU governments have set very ambitious growth targets for hydrogen as part of the REPowerEU plan, and with that, provided huge government subsidies. President Biden’s US Inflation Reduction Act injects US$369bn into clean energy initiatives including a huge public subsidy to enhance the development of hydrogen (providing an inflation adjusted 10-year US$3/kg production tax credit) sufficient to drive learning by doing and upscaling of capacity. Given the expected rapid decline in electrolyser costs this coming decade, first movers have a capital cost disadvantage.

It is very telling how the hyperinflation of fossil fuel commodity prices globally over 2022 has really narrowed the cost disadvantage on green hydrogen, where at today’s hyperinflated methane gas / LNG prices, fossil or grey hydrogen is more expensive than green hydrogen. And Putin’s invasion of Ukraine has highlighted the value of energy security and Carbon Tracker reports it has spurred over US$70bn of new GH2 proposals. But absent a high sustained price on CO2 emissions, subsidies of the magnitude now on offer in the US are going to be needed for some time yet.

While Australian state and federal governments are very interested in the hydrogen opportunity, we have not seen multi-billion subsides flowing to the sector here. Nor do we have a commercial price on carbon emissions, although the safeguard mechanism is working with corporate and financial net zero emissions pledges to accelerate momentum, while the Albanese Government is also working to restore credibility and effectiveness of the ACCU market by the Independent Chubb Review. But short of loss-leading government subsidies and a market price on emissions, Australia is at a competitive disadvantage in hydrogen to our key global competitors in this race to decarbonisation. Hence the domestic priority is to electrify everything, and progressively build up hydrogen capabilities for scaling up as cost deflation is delivered.

So when we talk about the listed ASX exposure to hydrogen, this mainly comes in the form of energy and mining majors who have the financial resources and patience to invest over the coming decade, for example. Fortescue, Woodside and Origin Energy, as well as BP and Yara in terms of global energy majors.

Fortescue’s FFI has made a huge number of global announcements and non-binding MoUs, and is currently investing some US$600m pa in RD&D on decarbonisation. It is noteworthy how FFI’s priority has shifted more recently to the tangible in-house imported fossil fuel replacement opportunities in decarbonising its hugely energy intensive iron ore business, a captive market to scale up and learn by doing, delivering immediate cost savings to justify the proposed US$6bn investment over this decade. FFI is still very focused on the import replacement and export opportunities in green ammonia as the second round of opportunity – with the Gibson Island, Brisbane green ammonia proposal in partnership with Incitec expected to reach a Final Investment Decision by June 2023[1] and Gladstone electrolyzer manufacturing plant under construction.[2] The yet to be proven export of liquid hydrogen probably won’t be commercialised at scale till some time next decade.

Caution is advisable on the question of pursuing immediate opportunities in the hydrogen sector in Australia today. The sector needs patient, strategic capital and a lot of learning by doing and scaling up. Near term, global capital is likely to mostly gravitate to Germany, UK or the US when first loss government subsidies are plentiful.

As Climate Energy Finance has written,[3] the massive commercial opportunities in the booming critical minerals export sector in Australia are more tangible and attractive near term, even with the hype associated with the tenfold rise in lithium commodity prices over the last 18-24 months. One should expect that hyped-pricing to subside at some stage as the inevitable supply response occurs, but there are clear structural growth drivers evident today, such as the doubling of plug-in and EV sales in China in 2022 year on year, year to date. Largely so far led by China (e.g. BYD and CATL), and Tesla in the US, the global EV disruption has accelerated massively this year, and now looks to be largely unstoppable this decade, a pull forward in timeframe of 5-10 years in even the last two years. Australia is in pole position to establish itself as a critical minerals mining and refining superpower to supply this market. But as highlighted by the US$2.8bn battery manufacturing supply chain subsidies announced by the US government’s Department of Energy, the global race is definitely on, and public private partnerships are needed to capitalise on Australia’s opportunity.

Tim Buckley, Director, Climate Energy Finance, 24 October 2022

Climate Energy Finance is a public interest thinktank. We examine global and Australian energy decarbonisation trends and the role of finance in accelerating the transition. CEF does not provide personal or general financial advice.

[1] Fortescue Metals Group, Fortescue Future Industries and Incitec Pivot progress green conversion of Gibson Island ammonia facility, 7 October 2022

[2] PV Magazine, Fortescue’s 2 GW electrolyser factory is just the beginning, 7 September 2022

[3] CEF, When critical minerals and decarbonisation collide: eight newer value-add refining proposals in Australia & NZ, 18 October 2022